Landmark Tax Accountant Corporation

Landmark Tax Accountant Corporation decides to hold additional seminars on how to deal with the 2024 Inheritance Problem

Countdown to changes in living gift and inheritance registration system ……

Landmark Tax Accountant Corporation (Headquarters: Chiyoda-ku, Tokyo; Representative: Yukihiro Kiyota https://www.zeirisi.co.jp/), which handles Japan’s top-class inheritance support services, is currently dealing with changes in inheritance-related systems that are just around the corner. We have held seminars to explain countermeasures for the impact of the 2024 Inheritance Problem. Now, we have decided to hold an additional event in Shin-Yokohama on Monday, December 11, 2023. At the seminar, in preparation for system changes regarding inter vivos gifts, inheritance registration, etc. and the start of operation of a new calculation formula for condominium appraised values that are scheduled to take place after January 2024, we will provide a detailed explanation of the changes and the impact of the revisions, as well as provide individual consultation services. I agree.

[Image 1

■“Inheritance 2024 Issues” Seminar Overview

・Date and time: December 11th (Monday) 14:00-16:00 [Individual consultation: 15:00-16:00 (*reservation required)]

・Place: Landmark Tax Accountant Corporation Shin-Yokohama Seminar Room 6th floor, Nippon Life Insurance Shin-Yokohama Building, 2-4-1 Shin-Yokohama, Kohoku-ku, Yokohama-shi, Kanagawa Prefecture

・Application: Special website (https://lp.zeirisi.co.jp/),

Please apply from or toll free number 0120-48-7271

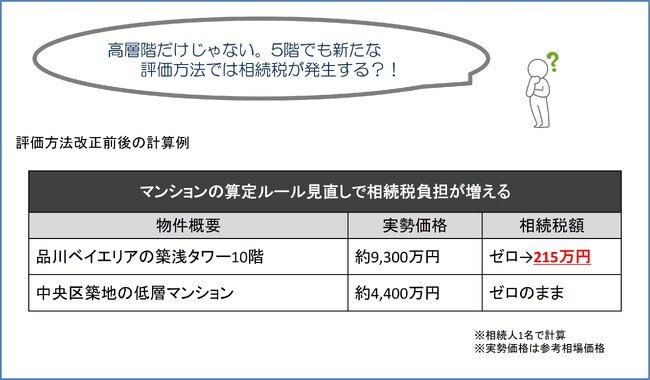

■Is there a possibility that inheritance tax will increase after 2024? ! From January 2024 onwards, there will be major changes to the system regarding inter vivos gifts and inheritance registration. Confusion is expected due to the reduction of the benefits of calendar-year taxable gifts, which have been the mainstream until now, and the requirement for inheritance registration, as well as penalties including fines of up to 100,000 yen for violations of the obligations. It is important to understand the revised points correctly and prepare early by identifying assets and calculating inheritance tax.

◎Calculation examples before and after the revision of condominium evaluation method

[Image 2

■“Inheritance 2024 Problem” video commentary site (YouTube)

[Image 3

https://youtu.be/lBNXtG7kmDo?si=pIWpxcR53V1iLM2i

A concise explanation of the key points of the 2024 Inheritance Problem. We recommend that you view it before attending the seminar. (6 minutes 27 seconds)

0:00 Introduction

0:42 1. Regarding mandatory inheritance registration

2:10 2. Regarding inheritance tax and gift tax revisions 4:19 3. Regarding the review of inheritance tax evaluation method for condominiums

5:33 Finally

[Image 4

▲Hold seminars from time to time

■About Landmark Tax Accountants Corporation

A tax accountant corporation specializing in asset taxes including inheritance tax. It is said that the average annual inheritance tax return per tax accountant is approximately 1.6, but we handle over 1,000 inheritance tax return cases annually. Since the establishment of our predecessor, Yukihiro Kiyota Tax Accountant Office, we have completed more than 7,500 inheritance tax returns and approximately 25,000 inheritance consultations, boasting one of the top inheritance tax filing records in Japan.

Company name: Landmark Tax Accountant Corporation (https://www.zeirisi.co.jp/) Representative: Yukihiro Kiyota

Location: 9th floor, Mitsubishi Building, 2-5-2 Marunouchi, Chiyoda-ku, Tokyo Established: January 4, 2008

Capital: 21.03 million yen

Business details: 1. Support for inheritance and business succession measures 2. Inheritance procedure support, inheritance tax declaration 3. Property tax consulting 4. Tax audit preparation support Five. Financial statements, final tax returns

(individuals/corporations) 6. Seminar held

More details about this release:

https://prtimes.jp/main/html/rd/p/000000066.000005953.html