risk monster

10th “Corporate Awareness of Transaction Risks” Survey Business Conditions DI turns positive, but the incidence of bankruptcy predictions and collection abnormalities rises

~ “Rismon’s one-stop service of credit management and anti-social checks” contributes to reducing transaction risks ~

……

Risk Monster Co., Ltd. (Headquarters: Chuo-ku, Tokyo, President: Taichi Fujimoto, hereinafter referred to as Rismon), which provides credit management cloud services for corporate members, is a member company that uses Rismon’s credit management services (hereinafter referred to as RM members). We have announced the results of the 10th “Corporate Awareness of Transaction Risks” survey conducted among companies with sales of 1 billion yen or more (hereinafter referred to as non-members).

・The business conditions DI in this survey was 5.7 points, a return to a positive value from the negative value in the 9th survey conducted in 2022 (-1.1 points).

– Approximately 80% of responding companies answered, “I think the number of bankruptcies will increase in the future,” and only a minority of companies were optimistic about the future.

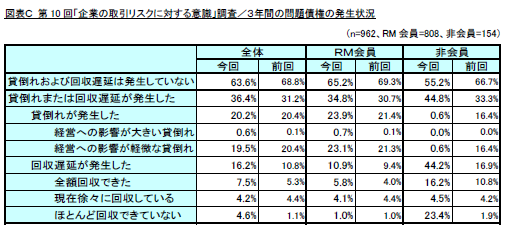

・Even though the overall incidence of collection abnormalities is increasing, two-thirds of RM members have not experienced collection abnormalities, and Rismon Service is contributing to corporate risk management even in an unstable economic environment. You can say that. Risk Monster Co., Ltd. (Headquarters: Chuo-ku, Tokyo, President: Taichi Fujimoto, hereinafter referred to as Rismon), which provides credit management cloud services for corporate members, is a member company that uses Rismon’s credit management services (hereinafter referred to as RM members). We have announced the results of the 10th “Corporate Awareness of Transaction Risks” survey conducted among companies with sales of 1 billion yen or more (hereinafter referred to as non-members).

The business conditions DI in this survey (the difference between the percentage of companies that responded that “business confidence has improved” and the percentage of companies that answered that “business confidence has worsened”) was 5.7 points, which is expected in 2022. This resulted in a recovery from the negative value of the 9th survey (minus 1.1 points) to a positive value.

While there are negative factors such as unstable economic trends such as high prices and a weaker yen, and an increase in bankruptcies due in part to the start of repayments of zero-zero loans, there are also negative factors such as the revitalization of economic activity and inbound consumption due to the transition to Type 5 COVID-19. It is thought that positive factors such as recovery contributed to the DI value turning positive. After recording the largest negative value in the history of this survey in the 7th survey (minus 56.5 points) conducted in 2020 during the coronavirus pandemic, business confidence has continued to wax and wane since the 8th survey.

On the other hand, approximately 80% of responding companies answered, “I think the number of bankruptcies will increase in the future,” and only a minority of companies were optimistic about the future. In fact, compared to the 9th survey, the incidence of collection abnormalities has increased, and the credit management budget is also on the rise. It appears that companies are strengthening their risk management for business partners.

Additionally, RM members tend to view business conditions more positively than non-members. Even though the overall incidence of collection abnormalities is increasing, two-thirds of RM members have not experienced collection abnormalities, indicating that Rismon Service is contributing to corporate risk management even in an unstable economic environment. Yes.

Going forward, Rismon will continue to educate the importance of credit management and support companies in effective and efficient credit management through the provision of one-stop credit management services, thereby contributing to the avoidance of bad debts and risky transactions. We will continue to contribute to the development of member companies.

▼The results of this survey can also be viewed on the following website. http://www.riskmonster.co.jp/rm-research/

▼Click here for the video version “YouTube Rismon Channel”

https://www.youtube.com/watch?v=neCXZ0EJdcs

[Investigation result]

(1) Business confidence recovers in “agriculture and forestry,” “medical care and welfare,” “transportation and postal industry,” and “wholesale and retail trade.”

When we conducted a questionnaire survey on business confidence among Japanese companies, we found that overall, the percentage of companies that answered that “business confidence has improved” and the percentage of companies that answered that “business confidence has worsened” The difference (DI) was 5.7 points. It appears that business confidence has improved compared to the previous survey conducted in 2022 (DI value -1.1 points). Both RM members ( 6.3 points) and non-members ( 2.6 points) have improved from the previous survey, and in particular, non-members, whose score was as low as -6.3 points last time, increased by 8.9 points. It’s turning into a positive.

Looking at the Business Conditions DI by industry, 9 out of 15 industries had positive values and 4 industries had negative values. Furthermore, compared to the previous survey, 11 industries have improved, and only 4 industries have deteriorated, indicating that there are differences in business confidence depending on the industry. Industries with particularly remarkable recovery include “Agriculture and Forestry” (DI value -100 points from last time → 0 points this time), “Medical and Welfare” (-50.0 points from last time → 0 points this time), “Transportation, “Postal industry” (down 30.0 points from last time → 6.3 points this time) and “Wholesale and retail trade” (down 7.2 points from last time → 10.8 points this time).

On the other hand, the industries with negative DI values were “finance industry, insurance industry” (DI value change -23.8 points) and “life-related services industry, entertainment industry” (DI value change -22.5 points).

Looking at the Business Conditions DI by region, 4 out of 8 regions had positive values, and DI values improved in 6 regions. Although three regions had negative values, there was no significant

deterioration in any region compared to the previous time, and even Hokkaido, which had the highest negative value (DI value -15.0 points), shows improvement from the previous time. (Chart A) [Image 1

https://www.riskmonster.co.jp/study/research/

https://www.riskmonster.co.jp/study/research/[Implementation overview]

・Survey name: 10th “Corporate Awareness of Transaction Risk” Survey ・Survey method: Internet survey and direct mail survey

・Survey area: Nationwide

・Period:

Risk Monster members (RM members) October 11, 2023 (Wednesday) to November 10, 2023 (Friday) Excluding Risk Monster members

(non-members) April 3, 2023 (Monday) to October 31, 2023 (Tuesday) ・Survey target: 2,604 RM member companies and non-members with sales of 1 billion yen or more

・Valid number of collections: RM members 874 samples, non-members 154 samples ■Lismon investigation video

The “10th Survey on Corporate Awareness of Transaction Risks” announced this time can also be viewed on YouTube’s “Rismon Channel.”

https://www.youtube.com/watch?v=neCXZ0EJdcs

▼Lismon investigation video capture

[Image 11

Established in September 2000. In December of the same year, we started an ASP cloud service business, an outsourcing service for credit management operations using the Internet. Since then, we have focused on business for corporate members, including education-related businesses (fixed-rate employee training service “Cybax Univ.”), business portal site business (groupware services, etc.), BPO service business, and overseas business (Libo (Shanghai)). ) Commercial Information Co., Ltd.) has expanded its service field and is developing its business with a comprehensive strategy.

As of the end of September 2023, the number of Rismon Group corporate members is 13,851 (of which 7,315 are credit management services, 3,096 are business portal sites, etc., 2,988 are education businesses, and 452 are others).

-Company Profile-

Company name: Risk Monster Co., Ltd.

Address: RMG Building, 2-16-5 Nihonbashi, Chuo-ku, Tokyo

Representative: Taichi Fujimoto, Representative Director and President Capital: 1,188,168,391 yen

URL: https://www.riskmonster.co.jp/